The best source on the Hunt brothers' silver corner is this post on wallstraits.com. This article on gold-eagle.com is also worth reading. This post takes some information from those two sources. I don't like the academic-style of writing where you footnote every fact.

In 1971, the US completely abandoned the gold standard. The US defaulted on its promise to foreign central banks that paper dollars could be redeemed in gold. The original default on the dollar really occurred in 1913 when the Federal Reserve was created, allowing the Federal Reserve to print more Federal Reserve Notes than physical gold was in the US Treasury. Alternatively, the default occurred in 1933 when President Roosevelt said that US citizens could no longer redeem their paper dollars for gold and that US citizens were not allowed to own gold.

The Hunt brothers were the sons of a wealthy oil billionaire. They started investing in silver as a hedge against inflation. When they started buying silver, it was still illegal to own gold. They chose silver as their inflation hedge.

The Hunt brothers realized that the dollar was now worthless unbacked paper. They famously said "Any fool can run a printing press!" They decided to convert their paper wealth to physical silver. When they first started buying silver, the price was under $2/ounce. Recently, silver was quoted at $18/ounce. Over 30 years, a gain of 9x is equivalent to an annualized return of 7.6%. If the Hunt brothers were able to buy-and-hold their silver, they would have made a respectable rate of return.

The Hunt brothers realized that the Federal Reserve was subsidizing negative real interest rates. Instead of taking an unleveraged long position in silver, the Hunt brothers used margin to buy up to 20x as much silver as they actually had capital.

If the Hunt brothers merely invested a bunch of their own money in silver, they would have profited immensely. However, they got greedy *AND* they got screwed over by the Federal Reserve and the rules of the commodities exchange (CFTC).

After investing their own money in silver, driving up the price, the Hunt brothers started seeking other people to invest in silver with them. They convinced some Arabs to invest oil money in silver along with them. You're a fool to invest in an asset *AFTER* someone else has made a huge purchase, driving up the price. The Hunt brothers were seeking other silver investors to drive up the silver price even more. This made the Hunt brothers' initial silver investment even more profitable.

The Hunt brothers took physical delivery of their silver. They hired sharpshooters to protect them as they transported their silver to their warehouse.

The Hunt brothers said repeatedly, "Our goal is not to corner the silver market. Our goal is to be long-term buy-and-hold investors in silver." The problem is that the Hunt brothers were using extensive leverage. Whenever you have a leveraged investment, you risk being bankrupted during the next bust phase of the business cycle. Unfortunately for the Hunt brothers, they were *NOT* financial industry insiders. The financial industry insiders changed the rules of the game after the Hunt brothers had bought a large amount of silver.

Even though the Hunt brothers said "We are not trying to corner silver.", their actions were the same as someone attempting a corner. In a commodity market, cornering the market means buying so much of the commodity that you have a virtual monopoly. Monopolizing the supply, you can set the price at which you sell.

As you begin to corner the market in a commodity, the price naturally skyrockets. Suppose the price of silver is $18/ounce. You decide to invest $1 billion in silver, maximizing your leverage. You use 20x leverage, so you actually can buy $20 billion in silver. You have $20 billion in silver and a debt of $19 billion. HOWEVER, your purchase of silver has driven up the price. Suppose you were able to drive up the price 3x to $54/ounce. Now, you have $60 billion in silver and a debt of $19 billion. If you tried selling your silver, you would drive the price back down to $18. However, that's not the way margin rules work. Margin rules value your silver at the CURRENT PRICE. You only invested $1 billion, but your account now has $41 billion in equity ON PAPER. According to margin rules, you can use this equity to borrow more and buy even more silver! Anybody who tries to corner a commodity is taking advantage of this positive feedback cycle.

Real interest rates are negative, so this is a great deal! Your profits aren't free; they're paid by everyone else as inflation. Suppose inflation is 10% but the Fed Funds Rate is 5%. As you hold onto this position, you will benefit IMMENSELY from inflation.

That is the real reason "cornering the market" in a commodity is considered illegal/immoral. The real culprit is Federal Reserve negative real interest rates, combined with margin usage. As your attempted corner drives up the price, the margin rules mean that you can borrow more and buy more! Negative real interest rates mean that you profit immensely from using leverage. Money supply inflation is greater than the interest rate you are charged, and you will profit if you can hold onto your position long enough.

The Hunt brothers were exploiting the defect of negative real interest rates combined with margin rules. If real interest rates were not negative, but instead market-determined, this would not have been a profitable trade. If margin rules were based on liquidation price instead of current price, they would not have been able to drive up the price of silver so much.

At one point, the Hunt brothers had 77% of the world silver supply, either physically held or in the form of futures contracts. The Hunt brothers had substantially driven up the silver price.

The Hunt brothers were making a HUGE bet that the price of silver would continue to rise. At the same time, financial industry insiders started making a HUGE bet that the price of silver would crash. Guess who won the conflict?

The Hunt brothers were buying all the silver futures contracts they could, using leverage. Financial industry insiders were naked short selling all the silver futures contracts they could. There was no way all this silver could be physically delivered. There was a real risk that there would be a default on the silver futures contract.

Suppose you owned futures contracts for 1 billion ounces of silver while the world silver supply was only 200 million ounces. The futures exchange would be forced to default on its promise to deliver silver. As a commodity exchange, a failure to deliver is the most serious disaster you can have. The commodity exchange would collapse in default/bankruptcy. Large financial companies assume liability for the trades. They would be also forced into bankruptcy, because they would also be responsible for the commodity clearing default.

The large banks were smart to take a huge bet against the Hunt brothers. They knew the government and Federal Reserve would bail them out! There was *NO CHOICE* but to bail out the banks and screw over the Hunt brothers, because otherwise the financial system could have collapsed! There was no way that much silver could have been physically delivered! The Hunt brothers had practically bought more silver than existed!

Besides, nobody other than financial industry insiders is allowed to exploit the defects in the monetary system. Whenever someone else tries, an example must be made of them!

In a futures market or options market, there are two types of transactions. You can have an "opening transaction" or a "closing transaction". Suppose A, B, and C have no position in silver futures. Suppose A buys one contract from B. A now has a position of +1 and B has a position of -1. A new futures contract was created by B. Both A and B report their transaction as an "opening transaction", which means the total "open interest" has increased by 1. Suppose B now buys 1 contract from C. B's position changed from -1 to 0, so he reports a closing transaction. C's position changed from 0 to -1, so he reports an opening transaction. This is a closing transaction from B's point of view and an opening transaction from C's point of view. The total number of futures contracts is unchanged. Suppose C now buys 1 contract from A. A's position changes from +1 to 0 and C's position changes from -1 to 0. They both report a closing transaction. The number of outstanding contracts has decreased by one.

The "open interest" is the total number of outstanding contracts. An opening transaction is whenever a new contract is created, by one person increasing their long position and another person increasing the size of their short position. A closing transaction is whenever a contract is destroyed. In a closing transaction, someone who is long sells a contract they own, and someone who is short covers their short.

One quick way to calculate the "open interest" is you sum up the absolute value of everyone's position and divide by 2.

Due to the Hunt brothers' huge silver purchases, there was concern that the open interest was greater than the amount of physical silver available.

The Hunt brothers were screwed over by the government and the Federal Reserve. The CFTC/COMEX/CBOT are the regulators that set the rules for the commodities exchanges. The people sitting on the regulatory body are all financial industry insiders, EACH OF WHICH HAD A HUGE SHORT POSITION IN SILVER! First, they set position limits. The number of silver contracts each person could own was restricted, although the Hunt brothers' existing position was partially grandfathered. Second, THEY BANNED OPENING TRANSACTIONS. ONLY CLOSING TRANSACTIONS WERE ALLOWED. Third, they raised margin requirements for long speculators BUT NOT SHORT SPECULATORS! This forced the Hunt brothers into margin calls, while the short speculators could wait to buy and cover!

This meant that the Hunt brothers could *NO LONGER* buy silver to keep driving up the price. The only people they could sell to were the financial industry insiders, who had huge short positions. Knowing the rules of the game had been changed to favor them, the financial industry insiders knew they were going to be able to cover their humongous short position at favorable prices.

The Federal Reserve also joined the party. The Federal Reserve jacked up interest rates. This made it hard for the Hunt brothers to meet the interest payments on their margin debt. Borrowing at 5% to buy silver is a bargain when inflation is 15%. Borrowing at 20% to buy silver is a ripoff when inflation is 15%!

The Federal Reserve also issued a special request to banks. They were to stop issuing loans for "speculative activity". The Federal Reserve didn't specifically say they were targeting the Hunt brothers, but everyone knew they were. Without this request by the Federal Reserve, if the banks colluded to stop extending the Hunt brothers credit, they would be guilty of an antitrust violation. When the Federal Reserve said "Stop lending the Hunt brothers money", the banks felt comfortable colluding to stop loaning the Hunt brothers more money, which is what they wanted to do!

With high interest rates, the Hunt brothers were unable to make the interest payments. Temporarily, interest rates were positive; interest rates were greater than the rate of money supply expansion. This ruined the Hunt brothers' profit equation, using leverage to borrow and buy silver. The Hunt brothers were hit with margin calls. They had to sell their silver. The financial industry insiders had taken a huge short position. They profited immensely as the Hunt brothers were forced to sell.

The Hunt brothers were attempting to corner silver. Instead, the financial industry insiders had created a "short corner". The Hunt brothers had a huge position they had to liquidate, and the financial industry insiders were the only legal buyers! Only someone with a preexisting short position could buy! The financial industry insiders had "cornered" the right to buy silver futures contracts, while there was a huge seller!

Of course, criminal charges were pursued against the Hunt brothers for attempting to corner the silver market. The financial industry insiders changed the rules of the game to bankrupt the Hunt brothers. Of course, what they did was perfectly legal. That aspect is amusing to me. The Hunt brothers, who lost a fortune, were criminals. The financial industry insiders, who changed the rules of the futures exchanges to bankrupt the Hunt brothers, were not accused of criminal activity at all.

The silver price crashed. Many individuals bought silver after the Hunt brothers pushed up the price of silver. The MSM said that gold and silver were discredited as an investment.

Central banks have huge reserves of gold. The world's central banks confiscated the world's gold supply in 1933. Since the default on the dollar, central banks have been slowly selling off their gold reserves to keep the price down. Central banks also own some silver, but not as much as they own gold. The price of gold and silver are used as a benchmark for the devaluation of fiat money. It is important to make a gold and silver investment look bad. This makes fiat money look good.

It was important to bankrupt the Hunt brothers. People who speculate in gold or silver are betting against fiat money. Bankrupting the Hunt brothers made the dollar look strong in comparison. When the price of silver crashed, it created the false impression that the dollar had appreciated in value.

Cornering a commodities market is only immoral/illegal in the context of negative real interest rates combined with defective margin rules that mark your position to market. In a truly free market, a corner is not profitable. Other investments would always be more attractive. Buying up the last bit of commodity to get a complete corner would be prohibitively expense. At some point, you'd be investing a lot of capital in a commodity that would just be sitting in a warehouse. It is *ONLY* state manipulation of the market that makes a commodity corner possible. Instead of fixing the defects in the monetary system, the government declares it illegal to attempt a corner.

The bottom line is that if you aren't a financial industry insider, you aren't going to profit borrowing to buy assets. If the Hunt brothers had taken an unleveraged long position in silver, they would have made a nice profit, and there's nothing the financial industry could have done to screw them over. Without using leverage, the Hunt brothers wouldn't have been able to push up the silver price that much, and they wouldn't be exploiting negative real interest rates and defects in the margin rules. The financial industry insiders will *ALWAYS* be bailed out by regulatory changes or by the Federal Reserve. In this case, the financial industry insiders had huge short positions. The insiders were bailed out regulatory changes and by the Federal Reserve jacking up interest rates, causing a temporary money supply crash.

Friday, February 29, 2008

The Hunt Brothers' Silver Corner

Posted by

FSK

at

12:00 PM

15

comments

![]()

![]()

Thursday, February 28, 2008

Reader Mail #39

I liked this post on Techdirt. Even if you encrypt your hard drive, it still is very easy for a criminal to steal you data. The YouTube video linked from the article is worth watching.

The problem is that the "decrypt hard drive key" is kept in memory. When you turn off your computer, memory is not immediately erased. If you freeze the memory, the rate of information decay is much slower.

I liked this post on the Agitator, linking to this YouTube Video. It is "None of Us Are Free,” by Solomon Burke, with the Blind Boys of Alabama. I don't usually like music videos, but this one was interesting.

I liked this excerpt from the song:

If you don't say it's wrong, that means you're saying it's right.

The bad guys rely on the fact that most people will ignore injustices until they're directly affected.

I liked this post on the Official Google Blog. Someone registered "superdelegates.org" and made a website enumerating who the superdelegates are.

I liked this post on the Technology Liberation Front. Verizon's DNS server misbehaves. If you enter a domain that does not exist, its DNS server does not return a "no such domain" error. Instead, it redirects you to Verizon's own search engine. A browser, by default, does a search when you enter a domain that does not exist.

Technically, this is not a violation of network neutrality. Is this behavior by Verizon immoral? If you're dumb enough to fall for it, you aren't smart enough for me to be concerned. Does it matter of a "no such domain" error defaults to my browser's search engine or Verizon's search engine?

I liked this post on Techdirt. The UK is banning filesharing of copyrighted content. I don't call this "illegal filesharing", because I don't recognize intellectual property as a legitimate form of property. The UK is forcing ISPs to crack down on people who fileshare copyrighted content.

All this means is that the filesharers are going to encrypt their traffic. It's impossible to stop filesharing without gutting the Internet.

I liked this post on to Herd or not to Herd.

Using violence against "violence experts" is the quickest way to have your organization or movement crushed. That is why governments frequently infiltrate opposition groups with agents provocateurs—to sidetrack the movement into violent channels that the violence professionals (police, military, security agencies, etc.) can deal with.

Resisting government violently is pointless. You are an individual or small group of individuals. The State has superior resources. It isn't possible to win a violent confrontation with the red market.

I liked this post on the Agitator.

A given middle school, high school, or college in American can expect to have exactly one homicide every 12,000 years.

The media uses a variation of the Strawman Fallacy. Statistically rare events are overhyped. This is used as an excuse to pass bad laws. Pretty much *EVERY* story where someone other than a policeman uses a gun inappropriately becomes a national headline. Stories of excessive police violence are usually buried, although the Internet is changing that somewhat.

Apparently, McCain is involved in some sort of sex scandal. Just once, I'd like to hear a politician say "Yes, I ****ed her, and we both enjoyed it."

I didn't like this post on George Washington's blog. His other content is good, but he has a huge error.

What are the options when people are dissatisfied with the government?

- Impeachment

- Violence

- Vote for someone else

I've seen this story cited on many sources, including Existentialist Cowboy. It is becoming commonplace for cops to carry video cameras with them to record everything they are doing. A cop carrying such a camera is accused of improperly beating a woman. Luckily for the cop, he TURNED OFF THE CAMERA before beating her. There is no evidence to prove that he improperly beat her.

The bottom line for me is that monopolistic government police have no legitimacy. Without competition, there is no market penalty for inappropriate police behavior.

I liked this post on Bill Rempel. There is a concept in investing called "alpha". If you say "My trading system has an alpha of 1% relative to the S&P 500", that means that, in the long run, you will outperform the S&P 500 by 1%. Alpha is ALWAYS the rate of one investment compared to another investment.

What should the benchmark be? The S&P 500 is most commonly used, but the S&P 500 has its own problems.

No investment site has ever suggested using M2 or M3 as the benchmark! If you say "My investment strategy returns 5% more than the growth rate of M3", that's impressive indeed!

After all, when the money supply increases, your investment system should AT A MINIMUM match the rate of money supply expansion. When you consider taxes and fees, even M2 (around 7%) is a high hurdle to overcome. Some sources estimate the rate of growth in M3 to be over 15%. The S&P 500 doesn't return over 15%!

That's one thing that really disturbs me. If the S&P 500 return lags growth in M3, does that really mean that gold, silver, and other metals are the best investment?

I liked this post on How to Save the World. It compares an abused dog to the average person under the current economic and political system. An abusive dog stays with its master, because that's the only life it knows. Similarly, abused people still support the State, because they can't imagine anything else.

It obviously didn't occur to the reporter that Lucky came back for more abuse because that's the only life he knew. He couldn't have survived in the wild, and couldn't have known that another, better life was waiting for him in just about any other house, with any other family.

We are all, in a real sense, like Lucky. Most of us, all over the world, struggle every day, and put up with a huge amount of stress and unhappiness in our lives.

we are oppressed with hierarchies, laws, rules and restrictions that would have driven our ancient ancestors quite mad

Why do we put up with it? Because it's the only life we know.

It has always struck me odd that wild creatures on this planet look after the needs of their community before their individual needs. This is natural to them. The 'dog-eat-dog' world is ours, not theirs! And gatherer-hunter cultures even today live leisurely lives compared to ours, and seem much happier with their natural way of living and making a living.

I believe it's because of the brainwashing we get in the education system, in the workplace, in the media, and in society at large, that we think the life-long, often joyless and meaningless struggle in the workplace is the only way to make a living. And that the disconnected, alienated way we live in anonymous communities is the only way to live.

I hadn't read that before. Animals in the wild take care of each other better than humans? It's possible. Pro-State brainwashing makes it hard to imagine how an "un-State-brainwashed" human would behave.

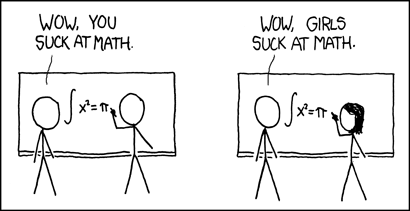

I liked this cartoon from the Freedom Symposium.

BTW, if you upload an image to Blogger via an Internet URL, it doesn't physically upload the image. It just gives a URL to the original source.

You have to download the image and re-upload it to get your own copy on Blogger. You have a 1GB limit for uploaded images.

Until my blog gets advanced enough that I self-host, I'm just going to link to pictures on other blogs. If they decide to replace their image with something disgusting, I'll go back and edit the post. My older "Reader Mail" posts don't get many views, so I'm not concerned.

I liked this post on Scholars and Rogues. It is about someone trying to succeed in post-apartheid South Africa.

My entrepreneurial development projects created thousands of new businesses. I lectured and taught all over the country.But it was like being on quicksand. As fast as I could start ‘em government entitlement programs would undermine them. Cut the legs out from underneath.

The only way to get ahead was through connections, pull and the appropriate high-profile “black” business partner.

Government programs, funded via taxes collected via violence, destroy free-market alternatives. The theme of "you need connections to succeed" is indicative of a communist society, not a free market.

What good is talent when those who would hire it no longer have the skills to appreciate it?

I feel that is my problem to a large extent. A highly skilled worker is at a *DISADVANTAGE* in many circumstances.

I liked these "Human Tetris" YouTube video clips. This is better than most American TV shows! I wonder if this is coming to the USA anytime soon? I read that FOX bought the USA rights.

I liked this article on counterpunch. At a large corporation, management prefers a weak, ineffective union to no union at all. This allows blame to be deflected from the corporation to the union.

When a union bureaucracy becomes large, the union management becomes more concerned with protecting their jobs instead of advocating for workers.

The problem is that government regulation of unions destroyed their effectiveness as being a TRUE advocate for workers' rights. Unions originally evolved to fight a defective economic system system that encouraged cartelization of industries. The wealthy elite responding by passing laws regulating unions. This turned unions into another form of corporation/bureaucracy. This neutered their effectiveness. The union leadership also liked the regulation, because it meant their job/loot was legitimized by state violence.

I liked this post on Check your Premises. Jack Kevorkian is famous for "assisted suicide". The government specifically created a law to target him and send him to jail. Even after several successful "jury nullification" defenses, the government kept trying and successfully got a conviction. Now, Jack Kevorkian is going around saying "Government has no legitimacy at all."

Assisted suicide isn't as stupid as it sounds. Modern medicine can keep an elderly person alive for years, while their quality of life is awful. The benefit is that hospitals, doctors, and drug companies profit immensely. Most of the medical industry's profits come from the last few years of a person's life. The medical industry has NO OBLIGATION to ensure that its patients actually have a decent quality of life. It only has to keep them alive so they continue to get a paycheck. "Assisted suicide" runs contrary to this practice.

"Assisted suicide" exposes an important lie of the medial industry. Elderly people who are kept alive via surgery and medication have a *LOUSY* quality of life.

I liked this post on Life, Love, and Liberty.

A very intelligent person I know once told me that most Americans are on the ethical level of Germans during World War 2 or something.

There are, fortunately, some exceptions. Remember: "I was just following orders" is *NEVER* a valid defense. If what you're doing is wrong, it doesn't matter if someone else ordered you to do it.

Unfortunately, my experience has been very disappointing. In today's corporate world, if you want to be successful WITHOUT DOING SOMETHING YOU KNOW IS WRONG, it's virtually impossible. Regrettably, knowing the difference between right and wrong and wanting to do something about it is a *SERIOUS* handicap in the modern work world.

This post on Anarchist Without Objectives shows that Zhwazi is out of touch with reality. It is a detailed description of how to use GPG (Gnu Privacy Guard).

Until strong encryption is seamlessly integrated with your E-Mail client, *AND* you convince a substantial number of people to go along, strong encryption isn't going to happen.

If you're serious about privacy, you need to strong encrypt *EVERY SINGLE COMMUNICATION*, even something trivial. This raises the spying costs for the bad guys.

Why should I use GPG if nobody else is using it? Someone should write a FireFox plugin so that GPG can be seamlessly integrated with something like gmail. I'm not giving up the convenience of gmail just to strong-encrypt all my E-Mail traffic.

Personally, I just assume the bad guys already have a keystroke logger installed on everyone's PC. There's no way to be sure such an easter egg isn't built into Vista. Just because the bad guys are collecting lots of data, that doesn't mean they're capable of using it intelligently!

I liked this post by Wenchypoo. Some hospitals have a rule that you can only wait in the emergency room for 4 hours. Staff are working around this restriction by leaving patients in ambulances for 5 hours! (I think Wenchypoo is writing from the UK and not the USA.)

The real cause of the health care crisis is government regulation of doctors and hospitals. You cannot work as a doctor without permission from the government. The AMA and the government conspire to keep the supply of doctors low, guaranteeing that doctors will always be well-paid. Hospitals are also severely regulated, limiting the amount of hospital space. This guarantees that the people who own/control hospitals (even the non-profits) make a huge salary.

The MSM *NEVER* says that the problem with health care is government regulation, artificially restricting supply.

I liked this video on IndieGames. I always wanted to try writing an independent game. Back in the mid-1980s, it was possible for a single person to write a hit game in 3-6 months. Nowadays, you need a huge team to write a successful game. I looked at DirectX a few years ago, and it was a PITA.

XNA and Xbox Live are creating a serious market for independent game developers. I haven't tried XNA yet, but it sounds cool. If XNA eliminates a lot of the annoying overhead present in DirectX, SDL, and OpenGL, then it would be *AWESOME*. Plus, I read that developing in C# is 2x-3x faster than developing in C++. The fact that a game would run slower under C# is irrelevant with modern CPUs.

This bit sounds like an advertisement for Microsoft and XNA, but it isn't.

I've always been interested in writing a game. Learning the tools seemed like a huge overhead to overcome. They weren't user-friendly from an amateur's point of view. By "amateur", I mean professional programmer, but not a professional game programmer.

I liked this post on Debt Prison.

I've subscribed to a whole bundle of RSS feeds lately. I'm going through my blog hitlist and aggressively filtering out the garbage.

I feel guilty about sending a blog to my rejects folder. I need be more aggressive with rejecting blogs that waste my time. If a blog *REALLY* has great content, one of my favorite blogs will cite it eventually.

Bill aka NO DooDahs! has left a new comment on your post "Reader Mail #38":

Yeah, I hit up on that concept with my 6 a.m. comment on Thursday:

"One additional possibility is that the rules, culture, and payout structure of hedge fund management create a situation where the rational, profit maximization strategy is to take risks that the trader would find unreasonable with their own money."

This is in reference to "Why are spread trades so popular?" The reason is that a "spread trade" has market-beating returns most of the time, and a 100% loss a tiny fraction of the time. If you're investing with other people's money, this is a great risk/reward profile.

Do you really expect me to go back to your blog to read comments? That's why I like my "Reader Mail" posts. Every non-spam comment gets a response highlighted in a "Reader Mail" post.

Bill Rempel gives out partial RSS feeds on his blog. I'm considering demoting his blog to my reject folder for that reason. Bill Rempel has enough occasionally interesting stuff to stay out of my rejects bin.

MY #1 BLOG PET PEEVE IS PARTIAL RSS FEEDS! DON'T DO IT!

It appears that Bill Rempel has enabled full RSS feeds. I don't know if that's an accident or a permanent upgrade of his blog. Partial RSS feeds are *ANNOYING*. There are plenty of ways to insert ads into an RSS feed, if that's what you want to do.

Zhwazi has left a new comment on your post "Reader Mail #38":

"Humans need to have a single person who is the ultimate final authority for settling disputes, with the ability to violently enforce his decisions." This one is false. Do you agree?

You used the word "authority"! You lose!

This was my first serious try at the taboo game. However, I should not have made such an oversight. This is easily corrected: "Humans need to have a single person who has the ultimate final decision for settling disputes, with the ability to violently enforce his rulings."

Besides, I "won" in the sense that the Anonymous pro-Monarchy pro-State troll stopped commenting. I take comments seriously, so if someone stops commenting garbage, I consider that to be desirable.

However, I have no way of knowing the ultimate fate of the Anonymous troll. Did I provide him with enlightenment? Did he get disgusted and is no longer reading my blog? There will always be Anonymous trolls posting comments, although I have no way of knowing if it's the same Anonymous troll or a new one.

According to Google Analytics, my reader statistics are increasing again. Fully recovered from my illness, my post quality is increasing again.

I only find the concept of "authority" to be useful in the sense of a "delegation of authority" or "authorization", and IMO, any other use of the word "authority" is an abuse based on the idea that the state is supposed to be authorized by "the people", and the resulting conflations. There is no authority without authorization. Authority in this sense is not logically necessary, but it is extremely useful.

I consider "authority" to be a tainted word that should be "tabooed". Authority has many simultaneous meanings. Authority has positive definitions and negative definitions. Therefore, you should not use the word "authority" when holding a political debate.

By E-Mail, gyakusetsu writes:

"Informality Thrives

Worldwide, people are increasingly buying and selling goods and services outside of the legal system...People choose this informal economy when their government's requirements in the legalized economy are costly, according to Worldwatch Institute's Vital Signs, 2007-2008...In Tanzania, an entrepreneur earning an average income would turn over all of his or her income to the government for four years just to get legal incorporation papers...Informal economies allow people to survive financially, but offer little protection and few rights to anyone in or around them."

While I disagree with the wording of the last part (since an economy can't "offer a right," for example), it's good to see these agorist-style information reaching larger audiences.

This is partially right. Government is responsible for REMOVING rights. In this case, the State was removing his right to work and start a business, by making the cost of regulation compliance expensive.

Government does not GRANT rights. Government TAKES AWAY rights. In a truly free market, you have pretty much unlimited rights, provided you don't injure someone else. In a truly free market, you have the right to anything provided you can afford it! Market competition guarantees that prices are reasonable.

Government takes away:

- the right to use sound money

- the right to work (via income taxes and regulation)

- the right to own property (via property taxes)

- the right to defend yourself or own a gun

- the right to hire police

- the right to a fair trial, both criminal and civil

- the right to health care, by restricting the supply of doctors and hospitals

- the right to travel (passports, driver's license)

- the right to drink/smoke/use drugs (by taxation or outright banning them)

I think an agorist revolution will start in the USA. In the USA, there is still a high level of personal independence and mistrust in government. It's nice to hear of progress in other countries. If any become sufficiently advanced, maybe I'll move there!

BTW, if you're E-Mailing me a comment and I haven't heard from you before, be careful! Gmail sometimes aggressively marks E-Mail as spam. I see everything that's a blog comment, because Blogger asks for moderation when you log in. If you E-Mail me something non-spam and don't get a response, leave a comment.

Posted by

FSK

at

12:00 PM

2

comments

![]()

![]()

Wednesday, February 27, 2008

What Will be the Next Asset Bubble?

Asset bubbles are inevitable with debt-based money, due to the Compound Interest Paradox. The most recent asset bubble was residential real estate and subprime mortgages. Before that, the asset bubble was in tech stocks and the overall stock market in the late 1990s. Where will the next asset bubble be?

The next asset bubble usually isn't the bubble that recently popped. People remember losing money and are reluctant to invest in that area again.

The stock market is the most likely candidate. It may be a narrow sector, or maybe the market as a whole. Banking stocks have been taking a heavy beating lately, so they are promising candidates for the next boom.

I have no idea where the next asset bubble is going to occur. I can guess. By the time you hear an asset bubble being touted on the MSM, it is probably already too late to invest.

When the Federal Reserve starts raising interest rates again, you know that the recently inflated asset bubble is at risk for popping. However, unless you're an insider who knows exactly what the Federal Reserve is going to do, trying to time the market is very risky. As a non-insider, it's too difficult to predict the top or bottom of the stock market. Sophisticated models are useless, except to the extent that the people at the Federal Reserve are using those same models. The ultimate factor is the market manipulation caused by the Federal Reserve and the government. This makes predicting the direction of the market incredibly risky.

The bottom line is that there *WILL* be another asset bubble. By the time you hear about it, the politically-connected insiders have already made their purchases. As an individual, you can predict that an asset bubble will occur, but you don't know exactly where or how long it will last.

Posted by

FSK

at

12:00 PM

4

comments

![]()

![]()

Tuesday, February 26, 2008

The Black-Scholes Formula is Wrong! - Part 5/12 - The Volatility Smile

Table of Contents

Part 1 - Overview and Background

Part 2 - Axioms

Part 3 - Formula Derivation

Part 4 - The Put/Call Parity Formula

Part 5 - The Volatility Smile

Part 6 - The Contradiction

Part 7 - Resolving the Contradiction

Part 8 - The Kelly Criterion

Part 9 - How FSK Trades Options

Part 10 - Only Fools and Hedge Funds Write Covered Calls

Part 11 - Other Options

Part 12 - Summary

According to the theory of the Black-Scholes formula, the volatility component of an option price should be the same for all strikes, the same for all times to expiration, and the same for calls and puts. For a long time, option prices did have the same volatility for all strikes, until October 1987.

At this point, anyone who owned deep out-of-the money put options made a fortune. Anyone who owned in-the-money calls lost less than someone who had made an equivalent long stock position.

The October 1987 crash caused options traders to reevaluate how they priced options. Now, different strikes are priced with different volatilities. This phenomenon is usually referred to as the "volatility smile". It is smile-shaped, because at-the-money strikes have the lowest volatility, and strikes further from the current underlying price have higher volatility.

There are people who will come up with all sorts of reasons to explain the "volatility smile". Basically, the volatility smile is a fudge factor that accounts for all discrepancies between the options theory and prices actually observed in the market.

This is also explained as the "fat tails problem". Stock prices do *NOT* follow a log-normal distribution. Extreme events such as the October 1987 crash occur a LOT more often than they would if stock prices followed a log-normal distribution, as predicted by the theory. The problem is that most stock price volatility is actually money supply volatility. Due to the Compound Interest Paradox, there are times when the money supply abruptly expands or contracts. This is the true explanation of the fat tails problem.

If the money supply abruptly contracts, the Federal Reserve will lower interest rates, causing the money supply to expand. If the money supply abruptly expands, the Federal Reserve will raise interest rates, causing the money supply to contract. However, there still is the occasional extreme expansion or contraction in the money supply.

The "volatility smile" is a fudge-factor workaround. It's easier for economists to justify the "volatility smile" as "compensation for small errors in the model" instead of "the US economy is not really a free market".

In my next post, I give a detailed explanation of the contradiction.

Posted by

FSK

at

3:49 PM

1 comments

![]()

![]()

Monday, February 25, 2008

Reader Mail #38

Occasionally, someone googles "Who is FSK?" I looked at the results. There are a lot of people besides me going by the initials "FSK". If you see an "FSK" elsewhere, it might or might not be me! Lately, I put a link back to my blog whenever I post, but not always!

I liked this post on to Herd or not to Herd, linking to this article. Essentially, Ben Bernanke made a speech saying the US economy is ****ed.

As a serious investor, you know what this means. We are near the bottom of the current recession. Due to sharp cuts in the Fed Funds Rate, the money supply should start sharply expanding soon. There will be another economic boom (i.e. money supply expansion) starting about now.

I liked this post on the Distributist Review, referring to this YouTube video. It is an English satirical interview with an investment banker about the subprime mortgage problem.

My favorite bit is when the interviewer asks the investment banker what needs to be done about the crisis. The investment banker says that government needs to give the financial firms back all the money they lost so they can go about lending as if nothing had happened.

When a central bank cuts interest rates, essentially it is printing new money and handing it to the banks.

Of course, if the government fails to bail out the banks, the entire financial system would collapse. With debt-based money, banks are needed to issue the money that the rest of the economy uses to trade.

When banks lose money, the money supply starts shrinking. With a lower capital base, bank regulations mean that banks can issue fewer loans. Without central bank intervention/bailout, there would be a hyperdeflationary crash of the money supply.

I liked this post on Techdirt. A hacker made $300k in trading profits by breaking into corporations computers and stealing information. US insider trading laws only apply when someone obtains information *LEGALLY*. The information was obtained illegally, so the insider trading laws do not apply.

He could be prosecuted for computer fraud. He was only charged with insider trading, and was the charges were dropped based on this technicality.

I liked this post on Check Your Premises, citing this YouTube video. Someone asked me what "MSM" stands for. It means "MainStream Media".

When people read words, they read the shape of the word instead of the full word. Whenever I read "Check Your Premises", my first interpretation is "Check that you actually have male sex organs." IMHO, based on the content of the blog, I like my version of the name better.

I liked this article on Techdirt. Should newspapers be barred from writing articles on a high-profile trial?

The fact that newspaper coverage of a trial can affect the outcome is evidence that the trial system itself is broken. Someone whose judgement can be affected by newspaper coverage is UNQUALIFIED to serve as a juror in ANY trial.

The principle that "jurors should have no information before a trial" is evidence that the legal system is defective. The MOST INFORMED jurors are the ones MOST QUALIFIED to judge.

For example, I could NEVER get on a jury for a technology patent lawsuit or ANY technical case at all. I know too much; therefore, I am ineligible.

If I were being interviewed for a tax evasion or drug possession trial, and if I felt motivated to help the defendant, I might conceal my personal views. Surprisingly, I haven't been called for jury duty in awhile.

I liked this post on Bill Rempel about "spread trades", although he sort of is missing the point. Bill Rempel says "I don't understand why spread trades are so popular."

For example, a spread trade is buying April oil futures while short selling an equal amount of March oil futures. If the March price of oil goes up, the April price should go up by an equal amount. You are owning oil for about a month. As with most long positions, you are the beneficiary of inflation and receiving a massive government subsidy.

With spread trades, *HUGE* leverage ratios are allowed. Your theoretical profit is only slight, but it is massively amplified by leverage. Under normal circumstances, you will make a decent profit. However, as with most leveraged positions, there is the chance of the occasional huge loss. Under normal market conditions, the April price of oil will be greater than the March price of oil, because there's one more month of money supply inflation. If the oil market starts suffering from severe backwardation, you can get screwed over. Backwardation is when the March price of oil is HIGHER than the April price of oil. Backwardation is due to temporary supply shortages. If you need to heat your home in March, an April futures contract is useless.

The reason spread trades are popular is that their payoff profile is as follows. You earn decent 20%-30% returns 90%+ of the time. You go bankrupt the rest of the time. As a professional trader gambling with other people's money, this is a GREAT risk/reward profile. Most of the time, you'll look like a genius and get a fat bonus. The rest of the time, you switch jobs and try again with someone else's money! An experienced trader can ALMOST ALWAYS find someone else to bankroll him, even after going broke!

I'm also going to put this bit as its own separate post.

I liked this article on Techdirt. The ACLU filed a lawsuit over illegal wiretapping by the government. The Federal appeals court and the US Supreme Court tossed out the lawsuit. The reason was that *ONLY* someone who has been illegally wiretapped can sue. The ACLU can't prove that the plaintiff was illegally wiretapped; therefore, they can't sue the Federal government.

The US Supreme Court did *NOT* rule the wiretapping was acceptable. They merely ruled that the ACLU lacked legal standing to file a lawsuit.

This is a neat catch-22. There's no way to *PROVE* you are the victim of a secret illegal wiretap. Therefore, nobody will ever be able to successfully file a lawsuit!

Of course, the real solution is, as always, "Who says the US Supreme Court has legitimacy? Why do those 9 people have the right to tell everyone else what to do?" Ironically, the US Supreme Court writes *MORE* laws than members of Congress! Most members of Congress let lobbyists write laws for them. Very few Congressmen read or write the actual laws; it would take forever! Most Supreme Court opinions are actually written by the members of the Supreme Court! The Supreme Court handles few enough cases that they have time to seriously review everything.

I liked this article on Techdirt. The Chinese government does not have well-defined guidelines for what content on the Internet should be censored. Instead, they aggressively go after ISPs after the fact whenever inappropriate content appears. In turn, this causes ISPs to be super-aggressive when it comes to censorship. Every once in awhile, the Chinese government needs to put some people in jail, just to keep everyone else scared.

I liked this post on Classically Liberal. Biofuels are *NOT* really more efficient than oil at this time. They only are profitable in the context of government regulations requiring their use.

As usual, government environmental regulations are an excuse for a handful of people to line their pockets at the expense of everyone else.

I liked this post on The Long Tail. Suze Orzman appeared on Oprah's show and offered her book as a free download. Even though people could download the book for free, her Amazon.com sales rank *SKYROCKETED*.

When I watch CNBC, all the analysts are saying "SELL ALL YOUR STOCKS! CONVERT ALL YOUR MONEY TO CASH! SELL! SELL!! *SELL*!!!" It's like they're calling the market bottom.

In 2002, my coworkers were bragging about how they all pulled all their money out of the stock market. At the time, I was thinking "This must be the bottom of the stock market."

If you invest in long-term bonds at the bottom of the business cycle, you will lose money. As interest rates rise, existing bonds become worth less money. With bonds, there are two risks. First, you're practically guaranteed to lose out to inflation, which is really 7%-15%. Second, when interest rates rise, the market value of your existing bonds becomes worth less. Only banks and hedge funds, which can borrow at the Fed Funds Rate, can profitably invest in bonds. They don't care that the inflation-adjusted return is negative, because they get to use substantial leverage.

I liked this post on George Washington's blog. There are plans to keep the US government going in the event of a disaster. Were "continuity of government" processes invoked after 9/11 and never revoked? Has the US Constitution been officially suspended. The poster is 140 years or 90 years or 70 years too late, depending on how you count.

When the southern states walked out of Congress in 1861, Congress no longer had a quorum. At that point, the US Constitution technically expired as a voluntary agreement among states. President Lincoln issued an executive order to get the government going again. Technically, the US Constitution was never properly reestablished.

In 1913, with the establishment of the Federal Reserve and the income tax, that was effectively the end of the US Constitution. The "limited government" principles of the Constitution went out the window with the Federal Reserve and income tax. Other sources *ALWAYS* take the official blame for problems with the economy. The Federal Reserve and income tax are never questioned.

In 1933, President Roosevelt defaulted on the US dollar and declared the US bankrupt. Some people say that, technically, the US government has been operating illegitimately under a state of emergency since 1933.

For all practical purposes, the US Constitution is "just a piece of paper". If the people who control the government have no interest in following the US Constitution, it is useless. The form of the US Constitution is still vaguely followed so that people don't outright revolt. The US Constitution is a failed and discredited model for organizing a government.

I liked this post on George Washington's blog.

phrases like "bankruptcy" and "future" trigger all portions of a person's brain (logical, emotional, and survivalist) and so are very persuasive.

Let's play Overcoming Bias' "taboo your words" game with "bankruptcy". What do we mean by "The US government is bankrupt".

The US government has made future promises in the form of Social Security and Medicare that cannot possibly be kept. In that sense, the US government is bankrupt.

The US government has a debt of $10 trillion that cannot ever be repaid. This is only technically true. If the US government had a debt of 10 trillion euros, then it would be very bankrupt. However, the US government is the issuer of dollars. If Congress wanted, it could amend or repeal the Federal Reserve act, and directly print and spend $10 trillion to pay down the debt. The US government is *NOT* bankrupt because of its $10 trillion "national debt". With fiat money, the "national debt" is a legal fiction. The national debt is merely an excuse to transfer money to a certain group of people in the financial industry.

The US government has defaulted on its promise that $20 is redeemable for an ounce of gold. In this sense, the US government is very bankrupt. If a person did the exact same thing, they would be in bankruptcy court. However, governments are not subject to the same accounting rules as people.

So there are 3 different definitions of "bankrupt" that are commonly used:

If by "bankrupt", you mean "made future promises that cannot possibly be kept", then yes, the US government is bankrupt.

If by "bankrupt", you mean having a nominal debt in a currency the US issues, then the US government is NOT bankrupt. Congress can always raise the national debt ceiling. The Federal Reserve can create as many paper dollars as it chooses. Anytime it chooses, Congress can directly print and spend money to pay off the national debt.

If by "bankrupt", you mean having defaulted on a big promise in the past, then the US government is VERY bankrupt. The default on the gold standard is very serious. Technically, the US government has been bankrupt since it defaulted on the gold standard. The default on the dollar is the BIGGEST CREDIT DEFAULT in history, yet people say "The US government has a perfect credit rating". The US government has a perfect credit rating because it can ALWAYS print more dollars to pay off its debt.

The default on the dollar is not 100%, because it still has some purchasing power. The rate of default is 6%-15%, depending on what measure of inflation you use.

This topic deserves its own separate post.

Do people mind if I take some of the bits from these Reader Mail posts and publish them later as their own full post? Sometimes, I find myself writing a long and interesting bit in these Reader Mail Posts.

I liked this post on George Washington's blog. Some sources estimate that the total number of people who read blogs is GREATER than the total audience for network news.

The people who get on in this world are the people who get up and look for the circumstances they want, and, if they can't find them, make them.

- George Bernard Shaw

I want to create the circumstances of an underground agorist economy.

I liked this post on Unqualified Offerings. It's about replacing the word "test" with "assessment".

Let's play the "taboo your words" game. (That sure is useful.) Describe what is going on WITHOUT using the word "test" or "assessment".

What does someone mean when they say "test our students"?

Do you mean "Evaluate how well students are actually learning."?

Do you mean "Administer an evaluation with punitive results for those who fail, ensuring that students make a sincere effort to learn."?

In the context of education, "test" or "assessment" usually means the latter instead of the former. A "test" is about punishing those who fail to learn, instead of evaluating how much learning is actually occurring.

I liked this post on George Washington's blog. Surprise! The trials for prisoners held at Guantanamo bay aren't fair! That should be one big "Duh!"

I liked this post on Cafe Hayek. Creating jobs and creating wealth are not the same thing. For example, suppose the government passed a law mandating every child take 2 hours of piano training each day. This would create a lot of jobs for piano teachers. It would not create any real wealth.

I liked this post on Bubblegeneration, referring to this post. Google is now requiring domains to be 5 days old before allowing Adwords to be used on them. This effectively kills "domain tasting".

Actually, Google could go one step further. They could say "A new domain is not covered by our search index unless it is at least 5 days old." That would inconvenience zero legitimate users, while shutting out the "domain tasters".

This move by Google may actually be selfish. Some trademark owners have been considering suing Google over revenues lost due to domain tasting.

I liked this post on Bubblegeneration. Eventually, "open" social networks will shut "closed" networks out of the market. For example, Myspace and Facebook are "closed" networks, because they don't interact nicely with other social networking sites.

With Google's "open social" protocol, perhaps this will change.

Also, sites like Digg, del.icio.us, and Wikipedia have not rolled out any substantial new features in years. They are stagnating, while Google is continually coming up with lots of new products and tweaking its old products.

For example, Google Knol has the potential to eliminate Wikipedia, Digg, and many other websites. If Google Knol was implemented properly, it could be awesome! Google Knol, if done really well, could replace blogging!

I liked this post on Carnival of the Capitalists. As we already discussed, blog carnivals are an obsolete idea. Feed aggregators and other tools make blog carnivals irrelevant.

The Carnival of the Capitalists also had the "too much crap" problem that the Market Anarchist Carnival had.

This post on Yannone's blog is an interesting story about a fool. The State owns full allodial title to your house, and not you. Similarly, the State owns full allodial title to your car. You need permission from the State in order to drive.

Frustrated with this state of affairs, this individual decided to end all association with the DMV. He gave up the license plates for his car and gave up his driver's license.

*HOWEVER*, the harassment he faced from the police was *FAR GREATER* than the cost of complying with the regulation. He personally lost more time and effort than the damage he caused to the State. As a resistance tactic, this was extremely ineffective.

If you're the victim of inappropriate government activities, seeking redress in a government court is *POINTLESS*.

If you're serious about resisting the State, you should only pursue resistance activities that undermine State power *AND* show a profit at the same time. That's the whole point of agorism! The burden of taxes and government regulations are so great that this is easier than it sounds, once an underground economy gets started.

I liked this post on Techdirt. Adobe is adding DRM to Flash. According to the DMCA, this means that Adobe can sue third-parties who make Flash-compatible add-ons or Flash-compatible players.

This tactic by Adobe may backfire. It could mean that people switch from Flash to another scripting language.

I liked this post on The Picket Line.

Gandhi commented: “Withholding payment of taxes is one of the quickest methods of overthrowing a government.”

A former U.S. Secretary of State dismissed the threat of peaceful protestors with a similar argument, “Let them march all they want as long as they continue to pay their taxes.”

the great American writer Mark Twain remarked on the importance of legitimacy, “At bottom we know that the throne which the people support, stands and that when that support is removed, nothing in this world can save it.”

It is not strange that some people fear change. Mark Twain commented a century ago, “There are some that never know how to change. Circumstances may change, but those people are never able to see that they have got to change too, to meet those circumstances. All that they know is the one beaten track that their fathers and grandfathers have followed and that they themselves have followed in their turn. If an earthquake come and rip the land to chaos and that beaten track now lead over precipices and into morasses, those people can’t learn that they must strike out on a new road — no; they will march stupidly along and follow the old one to death and perdition.”

Actually, I *DO* consider it strange that some people fear change. If things aren't working, you should try something else.

Non-compliant tax avoidance operates on the principle that an illegitimate government has no right to levy taxes. This form of tax resistance should only be attempted in a collective exercise under the direction of a recognised authority, say the Law Society of Kenya or other civil society organisation.

I disagree. You can also resist taxes individually in secret. This is pro-State trolling again. "Humans need one form of authority to resist another form of authority"?

I liked this post on Overcoming Bias. The "Hawthorne Effect" says that if you change the lighting, workers' productivity improves. This has been cited in psychology texts as fact for decades.

It turns out that the original experiment was flawed. The results are incorrect. For 70 years, nobody bothered attempting to reproduce the experiment and verify the results. A commonly cited "fact" turns out to be false.

The problem is that scientists only receive grant money for *ORIGINAL* research. There is no grant money for checking previous results.

For example, why doesn't some professor at a research university perform an experiment to test "anti-psychotic drugs improve a patient's quality of life"? There is no research money for that. Instead, most psychiatrist professors study "Is drug A better than drug B?" The *LAST* thing a drug company wants is an independent evaluation of "Is drug A better than placebo?"

I liked this article on the Swedish recycling system. The government requires people to sort all their trash before throwing it out. Naturally, the cost of people spending time sorting their trash does *NOT* figure into the government's cost calculation.

When the red market forces people to waste time, that counts as a tax even though it never shows up on a balance sheet anywhere.

I liked this article on Techdirt. Google's Knol project may be a viable replacement for Wikipedia.

Unlike Wikipedia, Google's Knol will allow multiple competing articles on the same subject. If I write a article titled "Federal Reserve" that is sharply critical, then pro-State trolls will *NOT* be able to vandalize my article.

Probably, I will submit some of my best blog posts to Knol, to see how that goes.

I was Google Searching for "How do I get a Knol Invite?" My request was the #1 search result!

It's amusing reading all the articles on Knol. Google issued a single webpage/statement. Almost every other page I visited was just rehashing the information presented by Google in that one page.

David_Z has left a new comment on your post "Reader Mail #37":

"I don't get it. How does this post show what's wrong with Mathematics education?

A PhD is a waste of time. It is merely a piece of paper that says you wasted a certain number of years."

FSK - i was a little obtuse there. I'm fascinated by the B/S analysis you're doing. But much of the mathematics escapes me. This, I attribute to the failure of government schools.

I agree that the PhD is largely a waste of time, it was intriguing to me only as a personal academic pursuit, nothing more.

Mathematics education is bad *ON PURPOSE*. If people learned Mathematics well, they would be able to think properly. That would lead to all sorts of problems.

The Black-Scholes series is proving to be popular in Google search. It's getting me a few steady visits per day. It appears to be headed for the "Best of FSK" list. Usually, a popular post leads to a traffic spike, but that post series appears to merely be hitting a lot of Google searches where there isn't much competition.

Anonymous has left a new comment on your post "Reader Mail #37":

It is ridiculous to think human adults can live without some form of authority. It is not bullshit, it is wishful thinking. Even the market needs regulating to make sure there are no criminals operating.

Let's play the "Taboo Your Words" game. What do you mean by "authority"? Let's debate "Humans need authority to live" *WITHOUT* using the word "authority".

What do you mean by "authority"? Authority means a lot of different things.

"Humans need role models in order to live." That's acceptable, provided the role models lead by example instead of by force.

"Humans need to have their property violently stolen from them in order to live." This one is false. Do you agree? Once you realize "Taxation is theft", *ALL* forms of monopolistic government lose their legitimacy. Taxation is *ALWAYS* theft, whether it occurs in a monarchy or democracy.

"Humans need to have someone else make rules and violently enforce them in order to live." This one is false. Do you agree? What about the people who make the rules? What force makes sure that their rules are reasonable, IF THEY HAVE A MONOPOLY ON VIOLENCE?

"Humans need to have a mechanism for settling their disputes fairly." This one is true. Do you agree?

"Humans need to have a single person who is the ultimate final authority for settling disputes, with the ability to violently enforce his decisions." This one is false. Do you agree?

A monopolistic government court is *NOT* fair. A government court is expensive. It is possible for both parties to spend more on the trial than the value of the disputed property. If I think a government court is expensive and unfair, I do *NOT* have any alternatives.

Monarchist wars and Monarchical crisis of government do not tend to impact on the lives of the subjects, they still largely continue to live as they have always done. Democracies involve whole populations in their wars and their 'crisis' create social and civil unrest.

Is no authority better than monarchy. I think at some level the buck has to stop somewhere. Let us say, we have a conflict on interest over access to a river where our respective homesteads join, we cannot come to an agreement amongst ourselves...so we both agree to submit to a 'neutral' judge to decide for us. This is submitting to an authority. We can refuse and fight it out of course, but in such a society the hired gun and the hired army would be King, not anarchy.

If two people agree to the same judge and respect his decision, this is one of the valid instances of authority.

If you are rational, you will prefer a nonviolent resolution to a violent resolution. In a true agorist society, if you both purchased property insurance, you would be compensated in the event of an unfavorable ruling.

Ultimately, someone will own the river, or several people will jointly own it. In my vision of an agorist society, *ALL* property is owned. Once the ownership of the river is settled, and the owner uses it without injuring others, everything will be fine. As the government collapses, there probably will be some disputes over who owns the previously "public" land. In the present, the government has full allodial title to *ALL* property!

As for calling me a troll, or a fool just because I happen to disagree with your views..I think that is up to you, but not really conducive to our discussion. I dislike the State and consider it the ultimate and biggest criminal, I also think the genuine free market is largely self regulating, however we would need some final authority, with final say on things. Someone who can be reasoned with.

We are ultimately disagreeing over the definition of "authority". If you are unable to see that we are disagreeing over definitions, then yes, you are a troll or fool. If you are 100% certain that an agorist society would be a failure, then you are a fool. I'm not 100% certain of anything! I'm pretty sure that 2+2=4, but you'll never convince me that there isn't some contradiction in the laws of Mathematics that hasn't been discovered yet.

Democracies and structural governments have had wars were 50 and 60 million people have died! Such figures are beyond compare in a monarchy, even their largest battles only involved tens of thousands and usually only combattants not civilians.

You are making another logical fallacy. You have not convinced me that monarchy is superior to an agorist society. Both a democracy and a monarchy are illegitimate government from my point of view. Anyone who claims the right to steal is a criminal. It doesn't matter if you're a tax collector in a democracy, a monarchy, or Nazi Germany. All are equally criminals.

My point is "agorism is superior to both democracy and monarchy". You are saying "monarchy is superior to democracy". Such invalid reasoning convinces me that you are either a pro-State troll or a fool.

If you wish to continue this, play the "Taboo your words" game. Explain "people need authority" *WITHOUT* using the word "authority". We are using different definitions of the word "authority", and the word "authority" has many simultaneous meanings.

Posted by

FSK

at

12:00 PM

2

comments

![]()

![]()

Sunday, February 24, 2008

"Taboo Your Words" - From Overcoming Bias

I like this post on Overcoming Bias. They had another post on the same topic. If you have a debate about something, you should replace the word with what it actually means.

The idea comes from the game of "Taboo", where you have to describe something to your partner *WITHOUT* using a list of banned words.

When holding a political debate that is ultimately confused by definitions, both sides should be BARRED from using the word where they disagree on the definition.

For example, if you are debating "Taxation is theft!" with someone, you should replace taxes with what it really means. "Collecting money with the implied threat of violence obfuscated by complicated bureaucratic procedures is theft!"

For another example, consider "Inflation is theft!" More accurately, "When unbacked paper money loses value due to more of it being printed, that is theft!"

For another example, consider "Government should be eliminated." "A group of people who go around stealing should have their activities halted."

Let me know if you think of any other examples.

Posted by

FSK

at

12:00 PM

0

comments

![]()

![]()

FSK Asks - Does Anyone Have a Knol Invite?

I read about Google's Knol project on Techdirt. I am interested in submitting some of my blog content to Knol.

Knol sounds like a viable Wikipedia replacement. It will allow multiple competing articles on the same topic. Unlike Wikipedia, I can write an article critical of the Federal Reserve without other people vandalizing it. This means that Knol will be a much better information source than Wikipedia, because there won't be any of the "edit wars" problem that plague Wikipedia.

Knol is currently in "invitation only" private beta, just like gmail. If anyone has an invitation to give me, I'd experiment submitting some of my best blog content to Knol.

Posted by

FSK

at

11:00 AM

0

comments

![]()

![]()

Saturday, February 23, 2008

The Black-Scholes Formula is Wrong! - Part 4/12 - The Put/Call Parity Formula

Table of Contents

Part 1 - Overview and Background

Part 2 - Axioms

Part 3 - Formula Derivation

Part 4 - The Put/Call Parity Formula

Part 5 - The Volatility Smile

Part 6 - The Contradiction

Part 7 - Resolving the Contradiction

Part 8 - The Kelly Criterion

Part 9 - How FSK Trades Options

Part 10 - Only Fools and Hedge Funds Write Covered Calls

Part 11 - Other Options

Part 12 - Summary

When I first saw the put/call parity formula, my immediate reaction was "I call shenanigans!"

There's a formula frequently cited by options traders as justification for using "expected gain in stock equals the risk-free interest rate". This is called the put/call parity formula. I ignore the value of early exercising an option, which is typically worth only a few cents, about 1% of the option price.

Suppose I own a 1 year call option with a strike of $50 and I am short a 1 year put option with a strike of $50. What happens at expiration? If the stock is above $50, I will exercise my call option and my short put will expire worthless. If the stock is below $50, I will be assigned on my put and let my call expire worthless. I ignore the singularity when the stock is exactly at the strike at expiration. In that case, I will let my call expire worthless, and I don't know what the person who owns the put will do. If I get assigned on my put, I will immediately sell the stock for at most a small loss. In practice, this is a risky situation because I will be assigned on Friday evening and won't be able to sell until Monday morning. By then, all sorts of factors could have caused the stock to move.

In other words, if I own a 1 year call option and am short a 1 year put option, with the same expiration date and same strike of $50, I have a 1 year futures contract to buy the stock at $50. If I buy a call, short a put, and short 100 shares of stock, I have a riskless position. What is my cashflow? I will pay $50/share at expiration when I exercise my long call or am assigned on my short put. From now until expiration, I will collect the stock price times the risk-free interest rate in interest on my short stock position (minus any short sale fees). I am going to collect the current stock price when I short sell the stock right now. I am going to spend money buying a call and collect money when I short sell a put. (If the stock paid a dividend, I would also owe dividends on the short stock position, but I ignore dividends here.)

Summarizing,

C - P = S - X + basis

where

C is the call price

P is the put price

S is the current stock price

X is the strike price

and basis is the expected interest I will collect on the short stock position, plus the interest I will collect by delaying payment of the strike until expiration

In order to understand the put/call parity formula, just track the cashflow of the above riskless trade. Make sure you include all interest payments.

The above formula is called the put/call parity formula. There is only one degree of freedom in call and put prices, the volatility. If you know the call price, you can figure out the put price from the formula. If the observed options market price deviates too much from this formula, some market maker will perform arbitrage and make a guaranteed profit.

In the actual market, there are short transaction fees. This allows some wiggle room in real world options prices. If it's easy to borrow shares for short selling, the put/call parity formula holds pretty closely.

These riskless positions are given a special name "reversal" and "conversion". A conversion is when you are short a call, long a put, and own the stock. A reversal is when you are long a call, short a put, and short sell the stock. (I may have reversed the names, calling a "conversion" a "reversal" and vice versa.)

The put/call parity formula explains why professional options traders price options under the assumption that the expected gain in the stock equals the risk-free interest rate. If they priced options differently, other professional traders would conduct arbitrage against them.

When I first saw the put/call parity formula, my immediate reaction was "I call shenanigans!" Anyone who understands the put/call parity formula and does *NOT* call shenanigans is clueless. Many mainstream economists understand the put/call formula. It is standard for an introductory course on options theory.

Next time, I will write about the "volatility smile".

Posted by

FSK

at

12:00 PM

2

comments

![]()

![]()

FSK Mentions a Serious Blogger Bug

I discovered a pretty annoying bug in Blogger. I like to save a bunch of partially finished drafts. This ensures that posts, when I do publish them, have a high quality.

If you press "ENTER" while the cursor is in the "Title" edit box, Blogger publishes your post! Try it!

Posted by

FSK

at

11:00 AM

0

comments

![]()

![]()

Friday, February 22, 2008

The Defect of Intrade

Intrade's trading system is widely described as a great invention. However, there are fundamental flaws in its system that cause its markets to be inaccurate.

Intrade has a defect in its trading system that causes longshots to be overpriced. For example, "Ron Paul wins the Republican nomination" obviously has a value of zero, but its actual price is far greater than zero.

The problem is that, when making a long-term prediction, you are required to post margin equal to your worst-case loss, and you don't get credited with interest. For a longshot, short selling it would involve tying up a lot of capital without earning interest. This means that people can't profitably short-sell longshots.

I liked this post on Marginal Revolution about Intrade.

Mr. Ravitch has made a nice profit betting against Ron Paul, the libertarian who late last year was, amazingly, given almost a 10 percent chance of becoming the Republican nominee. “If you asked anyone in politics whether there was ever, at any point, a 10 percent chance of Ron Paul being the nominee,” Mr. Ravitch said, without finishing the sentence. “That sort of makes my case for me.”

There's a problem with Intrade's margin rules. Suppose you sold $1000 that Ron Paul would not win the nomination at 10% odds. In other words, you collected $1000 when you sold the "Ron Paul not nominated" contract. If Ron Paul would have won the nomination, you would owe another $9000. If Ron Paul is not nominated, you can keep the $1000 as profit.

The problem is that you are required to post the $9000 as margin collateral. To sell $1000 of "Ron Paul not nominated" futures, you need $9000 in your account. In other words, your profit (if you're right) is 11%. The "Ron Paul not nominated" contract does not settle until the nomination is officially announced. At the time, it was still a year until the convention. This means your profit rate would be 11%, which isn't even comparable to a stock market investment.

The real problem is that you don't earn interest on the $9000 collateral you were required to post as margin. If Intrade credited everyone with interest, then their market would be far more accurate.

If you wanted to create a fair online betting market, you should credit all accounts with interest. The market would automatically correct prices for long-term contracts. Currently, Intrade pockets the interest on all accounts.

Notice that short-term contracts aren't as distorted by the lack of interest credit. If you're betting on the Super Bowl outcome in late January, the effect of interest is negligible. If you're betting now on "Who will be elected President", then the lack of interest credits distorts the market.